The new business for the automotive sector that Mexico should take advantage of: lithium

The First Mobility Forum «UTOPIA RODANTE» was held in Mexico City where authorities, transportation organizations, taxi dealers and companies met to work towards sustainable mobility, seeking to establish public policies to accelerate the transition to sustainable mobility.

With the T-MEC, the exploitation of lithium gains importance, as a supply chain in North America must be ensured. Mexico has a great opportunity and wants to open up to private investment. The Mexican government has been exploring alternatives to develop a new chain from lithium reserves. In early June, the authorities confirmed that, instead of establishing a state monopoly on lithium, as proposed at the end of last year, a bill will be drawn up to promote private investments that help develop the country’s potential in the metal used to make batteries.

With the entry into force of Mexico’s trade agreement with the United States and Canada (T-MEC), the exploitation of lithium becomes more important since a supply chain in North America must be ensured. In three years, cars manufactured in these three countries must have at least 75% of their components produced in the region so that they can be marketed duty-free. This includes lithium batteries, which could become a profitable business for Mexico.

«It is not only about the extraction of lithium, we are looking for how to design a comprehensive project for Mexico to be successfully inserted in a value chain,» said Tatiana Clouthier, Secretary of Economy, during the meeting of the International Trade Commission of the Treaty. between Mexico, the United States and Canada (T-MEC), in mid-May. «If things go well, in a few months we will be laying the first stone for a company that would be installed for the production of batteries,» she added.

A single electric vehicle contains about 10 kilograms of lithium and although current demand from the automotive industry is still relatively low – electric cars accounted for less than 3% of global car sales last year – the UBS consultancy projects that they will be nearly half of all new car sales by 2030. As they begin to take over the roads, lithium stocks will be key to their production.

Distribution of lithium consumption globally

Asia concentrates the global demand for lithium. However, as the production of electric vehicles grows, the demand in other regions will also increase.

Country or region and Percentage:

- China 39%

- South Korea 20%

- Japan 18%

- Europe 10%

- North America 6%

- Rest of the world 7%

Source: «Report. Lithium: The new commercial dispute fueled by the false green market».

Although the current battery factories are owned by companies with well-known names, such as LG Chem, Panasonic or Samsung, their operation depends, to a large extent, on lithium mining companies.

One such company is the Chinese giant Ganfeng Lithium: the world’s third-largest lithium compound producer, China’s leading producer, and the majority partner of Bacanora Lithium, which owns four concessions in Sonora.

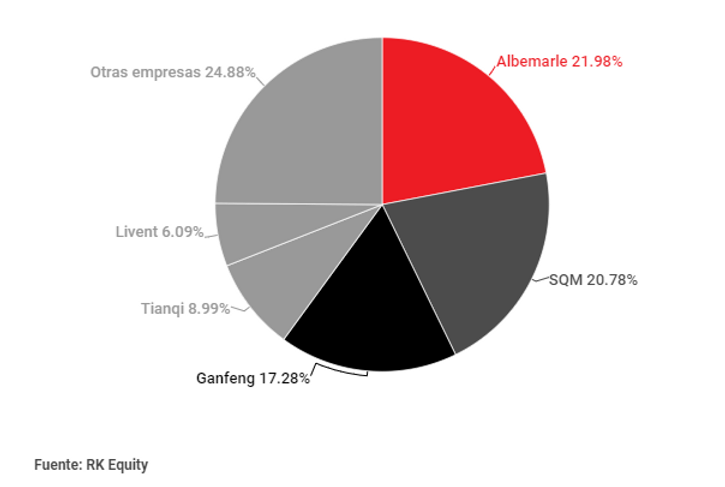

The largest lithium suppliers globally

Three companies control more than 70% of the world’s available lithium supply.

Although the exploitation of the Sonora deposit was awarded a decade ago, during the government of Felipe Calderón, and the role of the Mexican State was reduced to monitoring the project, in May President Andrés Manuel López Obrador said that the administration is considering assuming a more important role in lithium production, arguing that companies were using mining concessions for speculation rather than extracting the metal.

The 36 projects represent 95,000 hectares of mining concessions and another 537,000 in the process of review, according to data from the Comprehensive System on Mining Economy and the Ministry of the Economy. The vast majority are controlled by small Canadian companies that depend on the speculative nature of the market to generate interest and, therefore, investor resources in the Canadian stock exchanges. There are really only three companies that are active in Mexico and are making slow progress in their projects in Mexico: Bacanora Lithium, Organimax and One World Lithium.

Lithium concessions granted in Mexico

Currently in Mexico there are 36 lithium mining projects, all of them financed with foreign capital and controlled by 10 companies.

With electric vehicle sales expected to grow exponentially this decade, manufacturers will need to find a way to ensure a continuous supply of lithium. «It is not an easy business and until today it has not generated interesting profits like oil. But the outlook must improve with the demand for electric cars,» says Damian Frasier, spokesman for Bacanora in Mexico.